Bpi Savings Account

- Bpi Savings Account

- Bpi Savings Account Interest Rate

- Bpi Savings Account Initial Deposit

- Bpi Savings Account Registration

The savings account that earns interest and also comes with life insurance worth 3X your account balance. So what you save also benefits the family! Savings Account Product BPI Manage, organize and grow your money with our Savings accounts. The Savings account products provide the utmost convenience in safe keeping, managing and growing funds.

BPI Family Deposit Accounts - Savings Accounts

Saving and monitoring your money has never been easier.

We have a wide range of savings accounts that fit your individual needs, so you enjoy maximum convenience in safe keeping, managing and growing your funds

Regular Savings

Juggling your day-to-day finances is wonderfully simplified with a Regular Savings Account – your key to 24-hour superior electronic banking experience.

Required Initial Deposit: Php 1,000

A savings account specially designed for teens to help them develop the habit of saving at an early age.

Required Initial Deposit: Php 100

Save – Up

Need help to “force” yourself to save money with your payroll or transactional accounts? With Save-Up’s automatic funds transfer feature, it is easy to regularly set aside money from your payroll / transactional account to your Save-Up account every month.

Required Initial Deposit: None

Pamana Savings

BPI Family Pamana Savings Account allows you to save for your loved ones with FREE life insurance worth 3x of your account balance, up to PHP 2 million!

Required Initial Deposit:

- Php 5,000 (Peso Debit Card Variant)

- Php 50,000 (Peso Passbook Variant)

- $1,000 (US Dollar Variant)

A specially designed savings account for overseas Filipino Remitters. Now you can directly remit your hard-earned salary to your BPI Family Pamana Padala savings account. Affordable remittance fees and easy access through online banking.

Required Initial Deposit: Php 500

Padala Moneyger

An affordable savings account specially designed for those who receive remittances from abroad. This is the safe and secure way to manage your remittances.

Required Initial Deposit: None

Passbook

If you favor the recordkeeping ease of a passbook, then, Passbook Savings is the sensible way to safe keep your money. Earn interest on your funds and monitor your account transactions the simple way.

Required Initial Deposit:

- Php 10,000 (Peso Variant)

- $500 (US Dollar Variant)

Maxi-Saver

Looking for a higher yielding savings product with flexibility to withdraw anytime without penalty? Earn more as you save more and enjoy financial flexibility with Maxi-Saver.

Required Initial Deposit:

- Php 25,000 (Peso Debit Card Variant)

- Php 50,000 (Peso Passbook Variant)

- $2,500 (US Dollar Variant)

Deposits are insured by PDIC up to P500,000 per depositor.

Bank of the Philippine Islands (BPI) is one of the biggest and trusted banks in the country. If you are looking for a stable bank to place your hard-earned money, then you may consider opening an account with them. BPI also has over 800 branches in the country and close to 3,000 ATMs and cash deposit machines. It makes BPI, an excellent choice for a bank because there’s always a branch near your place.

Importance of Having a Savings Account

Did you know that the majority of Filipinos still do not own a bank account yet? As of the latest study in 2017, there’s only 22.6% of our population that has a bank account. That’s quite small, right? But because you’ll be opening yours soon, then this number will go up.

Convenience

Having a bank account means you don’t have to carry cash more than what you need, especially if you’re using public transport because you can access any ATM virtually anywhere if there’s a sudden need for extra cash.

Safe and Secured

Placing your money in a bank is safer and secure than leaving it inside your home and having your money away from catastrophic events like flood, fire, robbery, etc. Plus, your savings are insured up to Php 500k by PDIC should anything happen to the bank.

Enjoy Perks and Pay Online

Some ATM savings account will entitle you to exclusive discounts from your favorite stores. You can also use it to pay your online purchases. If you want to pay your utility bills in a breeze, then this can be your friend.

List of BPI Savings Account

BPI offers several types of savings account that will fit your financial need, and here they are.

1. BPI Kaya Savings Account

It is formerly known as the BPI Easy Savers account. It is effortless to open with just Php 200 initial deposit with no maintaining balance. The only drawback is that you’ll be charged Php 5 for each withdrawal, ATM card payment of Php 50, and with no interest.

Initial Deposit: Php 200

ATM Card Payment: Php 50

Maintaining Balance: n/a

Withdrawal Charge: Php 5 per withdrawal

Over-the-Counter Withdrawal Charge: Php 100 per withdrawal

Interest: n/a

2. BPI Express Teller Savings Account

It is a regular ATM savings account with an initial deposit of Php 500 and a maintaining balance of Php 3,000. You can use this at any ATM nationwide and online transactions like bills payment. You’ll also be entitled to receive interest on your savings account, which is usually paid every quarter-end.

Bpi Savings Account

Initial Deposit: Php 500

Maintaining Balance: Php 3,000

Withdrawal Charge: FREE

Interest: 0.25% p.a.

3. BPI Save-Up

It is an option for existing BPI ATM cardholders if you want to automate your savings. You can transfer your savings in this account from your existing BPI ATM card.

Initial Deposit: n/a

Maintaining Balance: Php 3,000 to earn interest

Withdrawal Charge: FREE

Interest: 0.5%-0.8% p.a.

Two Options: High Interest or Savings with Life Insurance

4. BPI Jumpstart

Teach your kids the value of money and the importance of saving it while they’re still young. It can also help you as a parent to monitor the withdrawals made by your children. And it can also help you in the timely transfer of their allowances from your account to theirs.

Initial Deposit: Php 100

Maintaining Balance: Php 500 or Php 1,000 to earn interest

Interest: 0.5% p.a.

5. BPI Maxi-Saver

Do you want a higher interest rate for your savings? If yes, then this might be the perfect savings account for you. It gives the highest possible return for your savings account, and it gives bonus interest when no withdrawal is made within a month.

Initial Deposit: Php 50,000 for ATM & Php 75,000 for Passbook

Maintaining Balance: Php 50,000 for ATM & Php 75,000 for Passbook

Bonus interest: 0.5% if no withdrawals made within a month

Basic Interest:

- Less than Php 50,000 – n/a

50,000 – Php 499,999 – 0.250%

500,000 – Php 999,999 – 0.375%

1M and above – 1.000%

6. BPI Passbook Savings Account

Passbook is an excellent choice if you would want it to make it a bit difficult to withdraw money to help you in keeping away from impulsive purchases.

Initial Deposit: Php 10,000

Maintaining Balance: Php 10,000 (Php 25,000 to earn interest)

Interest: 0.25%

Bpi Savings Account Interest Rate

7. BPI Pamana Savings Account

Get a FREE life insurance coverage of up to 3x of your account balance. The maximum life insurance coverage is up to Php 2 Million.

Initial Deposit: Php 50,000 for ATM & Php 75,000 for Passbook

Maintaining Balance: Php 50,000 for ATM & Php 75,000 for Passbook

READ: Top 10 Life Insurance Companies in the Philippines

READ: Sun Maxilink Prime The Best- Selling VUL Plan From Sun Life

Requirements in Opening a BPI Savings Account

So here are the requirements in opening a BPI savings account.

1. Two (2) Valid IDs

Bring 2 valid IDs and don’t forget to photocopy them because most of the time they will require these photocopies so don’t forget to bring them. Here’s the list of BPI accepted valid IDs.

2. Utility Bill

You may be required to bring a utility bill. It is to check your billing address. The bill doesn’t need to be under your name for as long as you’re currently residing in that address. You may bring any bill like electricity, phone, internet bill, etc.

3. 2 Latest 2×2 Pictures

BPI also accepts 1×1 pictures just in case you don’t have one. They have this signature card, where you will be required to sign multiple times and where your pictures will be attached. It will help them verify your identity or guard you against anyone who pretends to be you when there’s a suspicious transaction made in your account.

4. TIN Number

Most of the financial institutions now require a TIN before you can perform any financial transactions. So don’t forget to have it ready.

5. Initial Deposit Amount

Your initial deposit will depend on your chosen type of savings account. Chose the type that currently fits your financial needs.

The Ultimate Step-by-Step Guide in Opening BPI Account

Opening your first bank account is quite a task, and you don’t want to look ignorant while getting your account done. You can use this guide for you to have an idea of the flow when opening a BPI savings account.

1. Visit the Nearest Branch

First, you need to bring all the documents required, i.e., valid ID and initial deposit. Remember to always go to the nearest branch in your area. You don’t want to visit a bank kilometers away from home, right.

2. Get a Queuing Number

You can get the queuing number from the guard and tell him that you would want to open a savings account.

3. Fill out the Application Forms

Tell the teller first, what kind of savings account you would like to open. The teller will now give you all the forms you need to fill out. Once done, you may now hand all the requirements to the teller.

4. Verify and Quick Interview

Bpi Savings Account Initial Deposit

After filling out the forms, you may be asked to go for a short interview with the branch manager of the bank. Do not be afraid as questions will only be the same as what questions you answered earlier.

5. Get Your ATM Card or Passbook

After the interview, the teller will give you the passbook or the ATM card. In some instances, it will be given to you after 2-3 business days. If that’s the case, the teller will call you once your card is ready, or sometimes they will tell you the date of the availability of the card.

6. Change PIN and Enjoy Saving

Once you get your ATM card, you may now change the default PIN to your new and more secure PIN. After that, you are set. You can now use it and deposit more money in it or even pay your billers.

I hope this blog will help you in opening your first bank account with BPI. If you have questions or anything to share, please write it in the comment box below.

*****

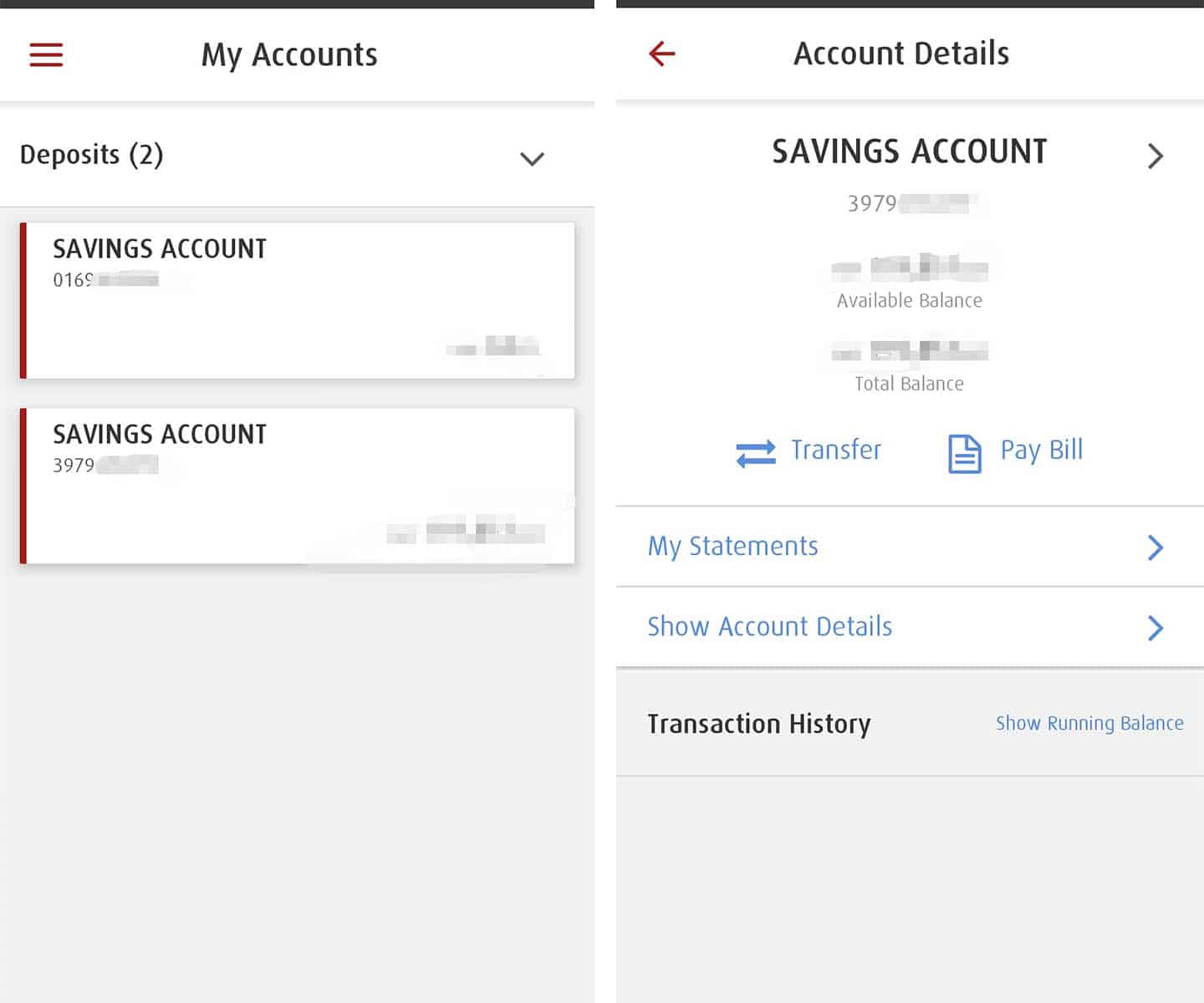

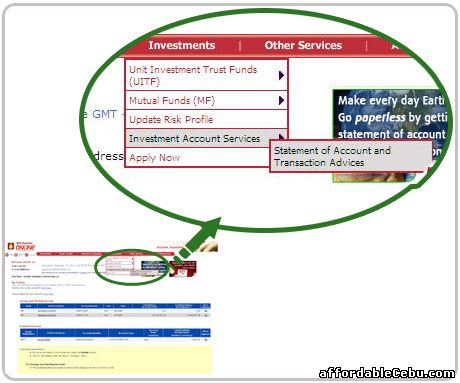

Bpi Savings Account Registration

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.