Standard Bank Fixed Deposit

Standard Bank Fixed Deposit Rates

Electronic Fixed Deposit Rates

These rates are effective from 05 April 2018

These rates apply to accounts opened by Standard Bank customers through Internet banking, Mobile App or at an AutoPlus machine.

If you invest in a Standard Chartered Bank fixed deposit, you can get interest rate of up to 7.50% p.a. The tenure range for the FD is between 7 days and 5 years. Standard Chartered Bank FD Interest Rates. Standard bank offer a fixed deposit account that pays interest of up to 6.4% interest rate depending on how much you invest. To get started you need to invest a minimum of R1,000.00. Pensioners over the. Fixed Deposit Deposit your savings into a fixed deposit and leave them to grow. Fixed Deposit Accounts earn higher interest than savings accounts, and don’t charge any service fees. Choose your investment.

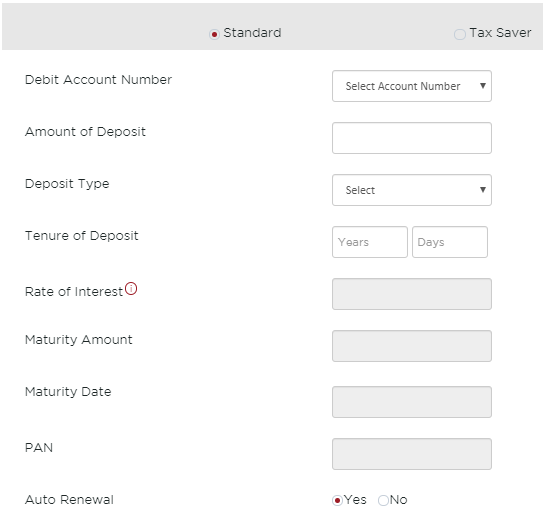

A Fixed Deposit is an investment account where money is deposited for a fixed period and the interest rate does not change. A Fixed Deposit offers higher interest rates than ordinary savings accounts and is ideal if you want to save for a specific goal, like the deposit for a wedding or a year-end holiday.

Interest rates are quoted as per annum rates.

| Balances R10 000 to R99 999 | Balances below R10 000 | |||

|---|---|---|---|---|

| Interest monthly | Interest at maturity | Interest monthly | Interest at maturity | |

| 33 days to under 3 months | 6.45% | 6.45% | 5.45% | 5.45% |

| 3 months to under 6 months | 6.75% | 6.75% | 5.75% | 5.75% |

| 6 months to under 12 months | 7.10% | 7.15% | 6.10% | 6.15% |

| 12 months to under 18 months | 7.45% | 7.35% | 6.45% | 6.35% |

| 18 months to under 24 months | 7.60% | 7.90% | 6.60% | 6.90% |

| 24 months to under 36 months | 7.65% | 8.05% | 6.65% | 7.05% |

| 36 months to under 48 months | 7.85% | 8.70% | 6.85% | 7.70% |

| 48 months to 60 months | 8.05% | 9.35% | 7.05% | 8.35% |

For balances of a R100 000 and above rates are applied on application.

Please note that for electronic rates we apply 0.15% preferential rate to ordinary interest rates.

Senior Citizen and Consolidator Fixed Deposits (These rates apply to customers aged 55 years old and older

These rates apply to accounts opened by Standard Bank customers through Internet banking, Mobile App or at an AutoPlus machine.

| Balances R10 000 to R99 999 | Balances below R10 000 | |||

|---|---|---|---|---|

| Interest monthly | Interest at maturity | Interest monthly | Interest at maturity | |

| 33 days to under 3 months | 6.95% | 6.95% | 5.95% | 5.95% |

| 3 months to under 6 months | 7.25% | 7.25% | 6.25% | 6.25% |

| 6 month to under 12 months | 7.60% | 7.65% | 6.60% | 6.65% |

| 12 months to under 18 months | 7.95% | 7.85% | 6.95% | 6.85% |

| 18 months to under 24 months | 8.10% | 8.40% | 7.10% | 7.40% |

| 24 months to under 36 months | 8.15% | 8.55% | 7.15% | 7.55% |

| 36 months to under 48 months | 8.35% | 9.20% | 7.35% | 8.20% |

| 48 months to 60 months | 8.55% | 9.85% | 7.55% | 8.85% |

For balances of a R100 000 and above rates are applied on application.

Which Bank Is Best For Fixed Deposits

Please note that for electronic rates we apply 0.15% preferential rate to ordinary interest rates.